Table of Contents

ToggleThe Future of CPA Firms: AI + PracticeERP + Workiro + Claude

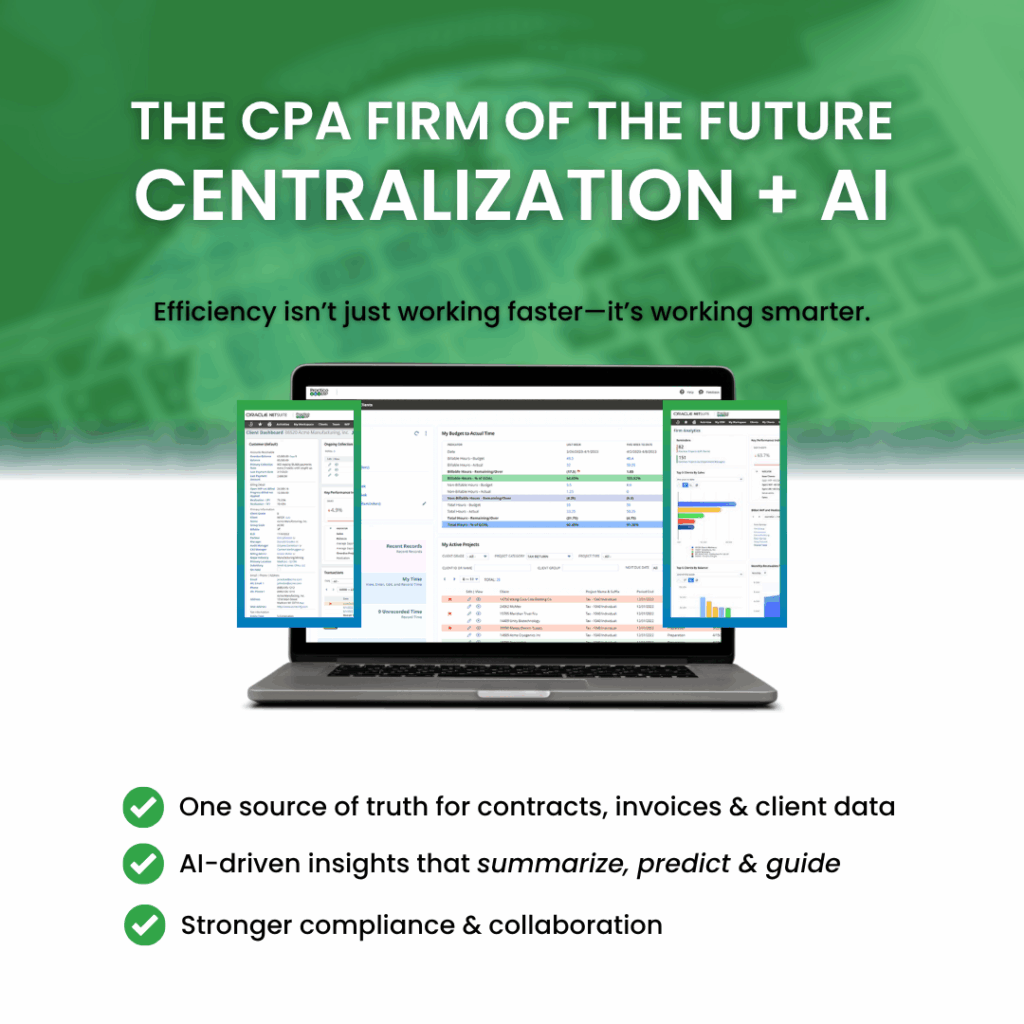

In today’s accounting world, efficiency isn’t just about working faster—it’s about working smarter. CPA firms that want to stay competitive need more than just automation. They need systems that centralize data, streamline collaboration, and unlock the true potential of Artificial Intelligence (AI).

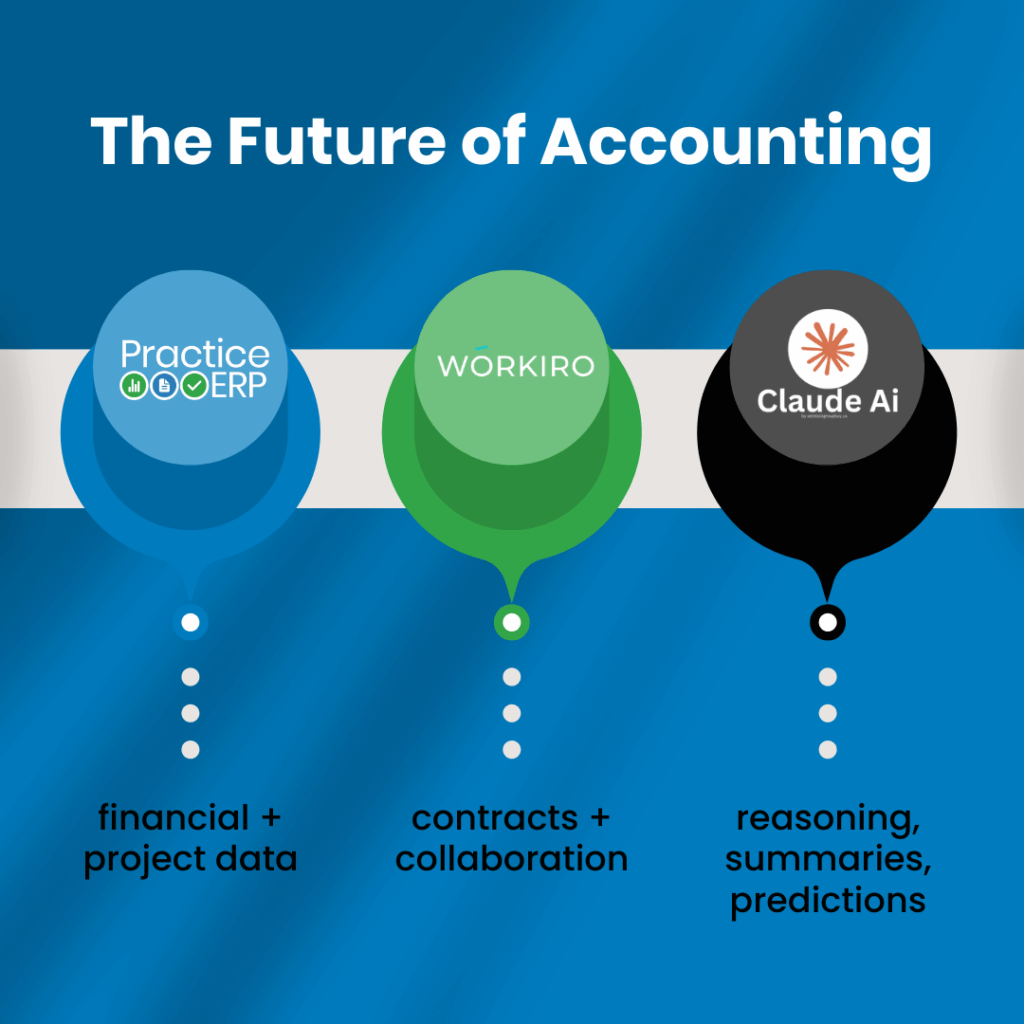

That’s where the combination of PracticeERP, Workiro, and Claude comes in. Together, they give CPA firms a powerful edge: one source of truth for financials, contracts, and client data—paired with AI that can reason, summarize, and predict.

AI in accounting is redefining how firms analyze data, detect anomalies, and deliver insights with greater accuracy and speed.

Why Centralization Matters

AI is only as strong as the information it can access. If your invoices are buried in one system, contracts scattered in another, and project data siloed elsewhere, AI can’t give you accurate insights.

When firms utilize PracticeERP (ERP built for CPA firms) together with Workiro (a collaboration and document management platform), they can manage invoices, contracts, communications, and financial data under one roof. This creates:

- Consistency: One version of truth across the firm.

- Transparency: Staff and partners access the same up-to-date documents.

- Control: Secure permissions and audit trails.

- Readiness for AI: Structured, centralized data that Claude can use to provide real insights.

Where Claude Adds the Intelligence

Claude, Anthropic’s AI, thrives when it has access to high-quality, structured information. When combined with PracticeERP and Workiro, Claude can:

Draft client-ready reports: by pulling contracts, invoices, and billing data into a cohesive narrative.

Answer business-critical questions:

- Which clients have contracts expiring in the next 90 days?

- How does that affect projected revenue?

- What invoices are overdue, and what’s the cash flow impact?

Summarize client engagements: by blending financial data from PracticeERP with contract terms from Workiro.

Enhance compliance workflows by surfacing inconsistencies between contracts and invoicing.

Use Cases for CPA Firms

1. Client Contract Management

A partner can ask Claude:

“Which contracts have rate increases coming up, and what invoices are tied to those clients?”

Claude retrieves contract data from Workiro and financials from PracticeERP, providing an at-a-glance summary with next steps for the partner.

2. Engagement Kickoffs

Instead of piecing together scope, contracts, and billing details manually, staff can ask Claude for a project kickoff brief. It will compile the signed contract, invoicing schedule, and ERP project data into a one-page summary.

3. Collections & Cash Flow

Claude can analyze overdue invoices, flag clients with repeated late payments, and even suggest follow-up email drafts that reference specific contract terms from Workiro.

4. Compliance & Risk Reviews

AI can surface mismatches between what’s in a signed engagement letter and what’s in actual billing data—helping firms stay audit-ready and avoid client disputes.

Transform Your Firm with AI in Accounting

Unlock the full power of centralized data, automation, and AI-driven insights.

Top AI Use Cases in CPA Firms 2025

1. Automated Data Entry & Processing

Firms are using AI to ingest invoices, receipts, contracts, and bank statements, automatically categorize them, reconcile, and post them—cutting down hours of manual work.

- In a 2024 accounting tech survey, 69% of accountants said they used AI for data entry and processing tasks.

- AI-powered extraction avoids human typos and speeds up throughput.

2. Document Summaries & Narrative Generation

AI is drafting memos, engagement summaries, and client correspondence based on data and documents.

- CPAs are using AI to summarize complex financial statements or technical tax rules into client-friendly language.

- This frees audit and tax staff from heavy writing and lets them focus on judgment, not formatting.

3. Real-Time Analytics, Alerts & Forecasting

AI models are analyzing KPIs to spot anomalies, forecast cash flow, and flag risks before they escalate.

- Predictive AI is commonly being embedded in accounting systems to flag irregularities or trends.

- Firms use AI to push real-time alerts (e.g. “Client invoice overdue by 45 days”) rather than waiting for monthly reports.

4. Tax & Compliance Support

AI helps with technical research, cross-referencing tax codes, identifying changes, and ensuring compliance.

- AI can explain tax changes in plain English and auto-generate client notifications tied to those events.

- Some firms centralize tax and regulatory information so AI can surface relevant rules per client.

5. Fraud & Anomaly Detection

AI is used to sift through large transactional datasets to detect outliers and potential fraud.

- Because AI can detect subtle patterns, firms use it to flag suspicious entries that human eyes might miss.

- This is especially valuable in high-volume bookkeeping or audit environments.

6. Agentic & Autonomous AI Agents

The next wave: AI agents that can take semi-autonomous actions (within guardrails).

- Agentic AI is anticipated to change how firms do tasks like client service, tax research, or workflow orchestration.

- Firms are evaluating how much decision autonomy to give these agents while retaining human oversight.

7. Internal Efficiency & Back-Office Automation

AI is helping firms manage internal operations: email drafting, internal reports, resource planning, ticketing, and more.

- In the “State of AI in Accounting” report, 59% of accounting professionals used AI for composing emails.

- Firms are also automating cross-departmental tasks previously handled via manual handoffs.

Adoption & Trend Stats to Watch

- In 2025, 21% of tax, audit & accounting firms say they are using GenAI at an enterprise level (up from 8% in 2024).

- Organizations that have formal AI strategies are twice as likely to see AI-driven revenue growth compared to those without.

- 46% of accountants now report using AI daily in their firms.

- Nearly all 98% respondents in one survey said they had used AI to help clients over the past year.

Centralize. Automate. Grow.

Discover how PracticeERP, Workiro, and Claude streamline operations and boost profitability for modern CPA firms.

The Competitive Advantage

CPA firms are under pressure to do more with less. Staffing shortages, rising client demands, and compliance challenges make it harder than ever to scale. By centralizing contracts, invoices, and data in Workiro and PracticeERP, then layering Claude AI on top, firms gain:

Faster decision-making

- Fewer manual errors

- Better client experiences

- New insights for growth

In short: Centralization + AI = the CPA firm of the future.

What These Stats Mean (& How AI Helps)

- Huge waste of talent & time: When CPA staff are stuck entering data, they’re not doing what firms pay them for: advisory, analysis, client interaction.

- Risk and error premium: Duplicate entries or misentered data lead to payments that shouldn’t happen, misstatements, and frustrated clients.

- Scalability ceiling: As volume of clients, invoices, and contracts grows, manual processes don’t scale without dramatic staff increases (and more errors).

- Data quality appears in your insights: AI, especially generative or reasoning models, only works well if the underlying data is clean and de-duplicated. If duplicates or inconsistencies are present, AI will reflect those mistakes.

With proper centralization (Workiro + PracticeERP) and AI tools like Claude, firms can:

- Automatically detect and prevent duplicates (invoice matching, contract linkage)

- Eliminate manual data entry or drastically reduce it

- Reclaim hours per week per person that can be redirected to higher-value work

- Improve reliability of insights and reporting

- Scale operations without linear increases in headcount

Final Takeaway

Data silos kill productivity—and they kill the power of AI. By integrating Workiro, PracticeERP, and Claude, CPA firms can unlock the true value of their data: smarter insights, seamless collaboration, and more time to focus on advisory services that clients truly value.

👉 Ready to see how AI can transform your firm?

Lead the Future of Accounting

Empower your CPA firm with intelligent automation and real-time decision-making.

FAQs

A cloud-based ERP system is a software solution hosted on remote servers, allowing firms to manage their operations online. For CPA firms, it offers scalability, data security, real-time insights, and automation to streamline workflows and improve efficiency.

These systems include advanced security features such as encryption, multi-factor authentication, and regular updates managed by experts. This significantly reduces risks compared to managing data on internal servers.

Yes, cloud-based ERP solutions are designed to align with regulatory standards like GDPR, SOC 2, and other financial data compliance requirements, ensuring your firm stays audit-ready year-round.

Cloud-based ERP systems provide anywhere, anytime access, enabling teams to collaborate and access critical information securely from any location with an internet connection.

Common automated tasks include data entry, payroll processing, invoice generation, and financial reporting, freeing up staff to focus on higher-value services.

Absolutely. These systems are designed to grow with your business, allowing you to add users, expand functionality, and handle larger datasets seamlessly.

Cloud-based ERP systems reduce IT infrastructure costs, eliminate the need for expensive hardware upgrades, and offer predictable subscription expenses, often resulting in long-term savings of up to 30%.

Many solutions include integrated CRM tools that help manage client interactions, automate follow-ups, and provide actionable insights, leading to stronger relationships and higher client retention.

Implementation varies by provider, but with solutions like PracticeERP, firms receive expert support to ensure a smooth transition, minimal disruption, and full team adoption.

The accounting industry is evolving rapidly, with increasing competition and client demands. A cloud-based ERP system equips CPA firms with the tools to stay ahead, streamline operations, and deliver exceptional client service.

News & Articles

Elevating Your CPA Firm: Strategies for Efficiency, Growth, and Long-Term Success

Elevating Your CPA Firm: Strategies for Efficiency, Growth, and Long-Term Success In today’s rapidly changing accounting landscape, CPA firms face mounting pressure to do more with less—less time, fewer people, and increasingly complex client expectations. Talent shortages, rising operational costs, … Read More

Data-Driven Decision-Making for CPA Firms: How ERP Systems Create Clarity, Control, and Growth

Why Data-Driven Decision-Making Matters for CPA Firms In today’s competitive accounting landscape, intuition is no longer enough. CPA firms are under pressure to operate more efficiently, serve clients better, and make faster, smarter decisions. The firms that succeed are those … Read More

CPA Burnout Is Real: How Unified Technology Can Help Firms Reclaim Time and Focus

CPA Burnout Is No Longer a Buzzword—It’s a Reality CPA burnout is no longer anecdotal—it’s measurable, persistent, and impacting firms of all sizes. In a recent collaborative webinar hosted by Workiro and PracticeERP, industry experts explored why burnout is accelerating … Read More